One of the pre-requisites here is to have a digital wallet to hold bitcoins. Buy Bitcoin Worldwide is for educational purposes only. So most coins are traded against Bitcoin rather than the US dollar or other fiat currencies. CME Group is the world’s leading and most diverse derivatives marketplace. Bank transfer is one of best ways to buy bitcoins in most countries.

Bitcoin Futures Specifications: Cboe and CME

Last updated: 3 October We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. But we may receive compensation when you click links on our site. Learn more about how we make money from our partners. Bitcoin futures trading lets you go long on Bitcoin if you want to bet on a price rise, or go short on Bitcoin if you want to bet on a price how to buy a bitcoin future. With this mechanism, you can profit from correctly betting that the price of Bitcoin will go up, which is called going long, or profit from correctly guessing that the price will go down, which is called going short.

Bitcoin futures turn two on December 18, 2019

![]()

The first U. Bitcoin futures will bring much-needed transparency, greater liquidity and efficient price discovery to the ecosystem. On October 31, , CME Group, the world’s leading and most diverse derivatives marketplace, had announced its intent to launch bitcoin futures in the fourth quarter of Both exchanges would allow exposure to bitcoin without having to hold any of the cryptocurrency. Cboe bitcoin USD futures are cash-settled futures contracts that are based on the Gemini Exchange auction price for bitcoin in U. The final settlement value will be the auction price for bitcoin in U. CT with one-hour break beginning at p.

New Bitcoin futures listing cycle starting December 16

Within a futures market, an investor is able to trade futures contracts, which involves the purchase of an asset class at futurd particular price with a settlement date set at some point in the future. The underlying value of the futures futuge for a particular instrument is then priced according to the actual asset itself, whether gold, crude, an index or individual stock.

Futures markets have been prevalent in the financial markets for many years, with the first modern era futures market reported to have been the Dojima Rice Exchange, launched in Japan in Futures contracts contain the details of the asset class in question together with the purchase size, final trading day, maturity date and exchange on which the contract is being bought or sold.

Futures contracts are created based on demand and do not get automatically created in the marketplace, involving two parties, where one party is going long on an asset class, while the other goes short. Upon expiry of a futures contract, the settlement is either physical, in the case of commodities, or via a cash settlement in the case of Bitcoin, though the futures contracts are likely to change hands on numerous occasions before expiry.

As investors have become more knowledgeable z the markets and the influences on futuee classes, the futures markets have become a guide for investors on the likely direction of commodities, stocks and indexes on a given day, fugure crude oil futures, gold futures and the the Dow Jones reflecting investor sentiment towards the respective instruments and the hod based on the flow of information that influences supply and demand dynamics.

For investors looking to hedge, there will already be some form of an exposure to the spot or physical and the futures markets allow the company or investor to protect the upside or downside with a futures contract.

As an example, airlines are well known to protect themselves against significant rises in crude oil prices, by buying a futures contract today with a specified price and delivery date in the future, on the assumption that oil prices will be on the rise over the period in question.

In this case, the airline is exposed to the cost fluctuations of crude oil as a physical but is looking to protect itself in the futures market. In this example, the airline would be taking a long position, while the party obligated to deliver the crude oil will be taking a short position, as they are the seller, while the airline is the buyer. An airline is unlikely to take a short position in crude oil, as declining prices benefit the bottom line.

In contrast to investors or companies looking to hedge exposures, speculators will be looking to benefit from bktcoin price fluctuations of an asset class without actually having a physical exposure to the asset class in bitcokn.

The incentive for a speculator is profit from the general direction of contracts decided upon by their outlook on supply and demand for the particular instrument. Hedgers can go either long or short. Short positions are taken to secure a price now in order to protect the hedger from declining prices in the future, while long positions protect against rising prices in gitcoin future.

Speculators go short on the expectation of prices falling in the future while going long on the assumption that prices will be on the rise.

With Bitcoin now having been in existence since and become futre sizeable instrument by market cap comparable to some of the largest listed companies on the U. S equity markets, it bitcoln as a little surprise that futures exchanges have moved ahead on offering investors with the option of Bitcoin futures contracts. The Cboe futures exchange launched Bitcoin futures on 10 th December and is considered to be the first step in the evolution of Bitcoin into a mature asset class, with the futures market providing investors with greater liquidity, transparency and an efficient price discovery.

CME Group followed Cboe with the launch of Bitcoin futures on 18 bitcin Decemberwith both exchanges providing hedgers with a platform to hedge existing exposure to Bitcoin, while both allow exposure to Bitcoin without actually owning Bitcoin, opening the door bifcoin the speculators. For Bitcoin, miners will receive gow relief from hos launch of the futures market, with the sizeable investments into mining equipment, not to mention exponential gains, needing some protection against price declines, while the speculator may be looking for the rally to continue and reach bitcoln stratospheric heights predicted by some in the marketplace, or in some cases, for the bubble to burst.

Both exchanges have opened the door for the larger institutional investors to get in on the Bitcoin game through a biy regulated, transparent and liquid market. Since Bitcoin is a virtual currency, settlements will be cash-based and in U. S Dollars and unlike the cryptomarkets, where trading isthe futures exchanges are not, with more regular trading hours and limited to 6-days per week.

For those looking to enter the Bitcoin futures market, the first and fundamental question is whether the motivation is speculative or to protect current Bitcoin earnings from any downside. Choice of exchange may be considered arbitrary, but it would be best to go with the exchange with the greatest number bitcoln futures contracts bitcoiin, as both will be considered liquid from an investor perspective.

As we addressed before, contract sizes differ on the respective exchanges as do margin requirements, so futurd are also considerations. Futuee looking to trade with margin, this is essentially the funding component of the trade executed on the futures exchange. As investors will not actually own Bitcoin itself, there is no need for the full value of the purchase to be paid in advance of the contract expiry date. In the event of an investor holding a contract until the expiration date, the amount paid, if out of the money, is limited to the difference between contract price and the actual price.

The margin is placed on a margin funding account as collateral for the trade. In addition to the collateral, also referred futufe as initial margin, investors are required to meet Mark-to-Market calls during the duration of the futures contract. The reverse is also possible, where the exchange funds the account where the investor has margins in excess of the required. In the event that the margin funding tto falls below acceptable levels, the investor will then be required to fund the account to meet future MTM requirements.

As we mentioned above, contract sizes between the futuge exchanges bitcoln different, with the minimum contract size on the CME Group exchange being 5 Bitcoins, compared with 1 Bitcoin on the Cboe exchange.

Final settlement on both exchanges is in U. S Dollars, with no actual Bitcoins held during the duration of the contract that requires settlement. With futures contracts being a 2-sided market, involving a buyer and a seller, counterparty risk on the final settlement is absorbed by the respective clearing houses and not the party in the money. For this reason, market liquidity is particularly important for those holding futures futurd as an inability to find a buyer can have quite dire consequences to the futures market and the price of Bitcoin.

Since the launch of the Cboe and CME Bitcoin futures, Bitcoin has received a double bounce in value, with the upside in Bitcoin bbuy off the back of Bitcoin futures valuations on each of the individual launch dates.

With the general theory being that the smarter futkre money is going into the Bitcoin futures market, investors in Bitcoin will be looking towards the futures market as butcoin guide to the future direction of Bitcoin, based on information available in the marketplace. Added to the influence of both the Cboe and CME group Bitcoin futures is the fact that both provide investors with the option to go long or short.

Increased appetite for lower prices would see the value furure Bitcoin futures contracts decline, which would likely lead to price declines in Bitcoin bitcpin. For now, the number of contracts is considered relatively small and investors may take less direction from the respective exchanges, but we will expect the number of contracts to grow over time and provide some idea on which direction Bitcoin will take on a given day.

For those who are interested in Bitcoin and other vuture trading, bbuy is a list of our recommended brokers. Coins Pairs Exchanges Wallets. Commodities Currencies Indices Cryptocurrencies. Trading tools Stock Exchanges. Understand Bitcoin Futures: A Step-by-Step Guide Futures markets have been in existence for the more mature asset classes, including commodities and equities for quite some time, however, Bitcoin futures how to buy a bitcoin future is a major step towards the legitimisation of the most popular cryptocurrency.

Bob Mason. What is Bitcoin Future? In summary: Hedgers can go either long or short. In contrast, the Cboe futures prices are based on a closing auction price of Bitcoin on a single Bitcoin exchange known as the Gemini exchange. With cryptocurrencies having experienced significant volatility, it comes as no surprise that both exchanges have quite high margin requirements.

The size of a margin requirement is a reflection of asset class volatility. Both exchanges involve cash settlement of futures contracts on expiration date On the Cboe futures exchange, a contract unit is equivalent to 1 Bitcoin, while on the CME Group exchange, one contract is equivalent to 5 Bitcoins. Contract expirations also differ. The CME Group will have futures contracts that expire in the nearest 2-months in the March quarterly cycle and the nearest 2-months outside of the quarterly cycle.

Bitcokn contrast, the Cboe group will list 3 near-term serial month contracts, before including 4 near-term expiration weekly contracts, 3 near-term serial months and 3-month March quarterly cycle contracts.

Limits are also in place on how far the respective exchanges allow prices to move before temporary and permanent halts are triggered. How to Buy and Sell Bitcoin Futures? Don’t miss a thing! Discover what’s moving the markets. Sign up for a daily update delivered to your inbox. Sign up. Latest Articles See All. Expand Your Knowledge See All. Psychology and Trading. CL Crude Oil.

Most Popular.

Coinbase Exchange Tutorial — How To Buy Bitcoin On Coinbase

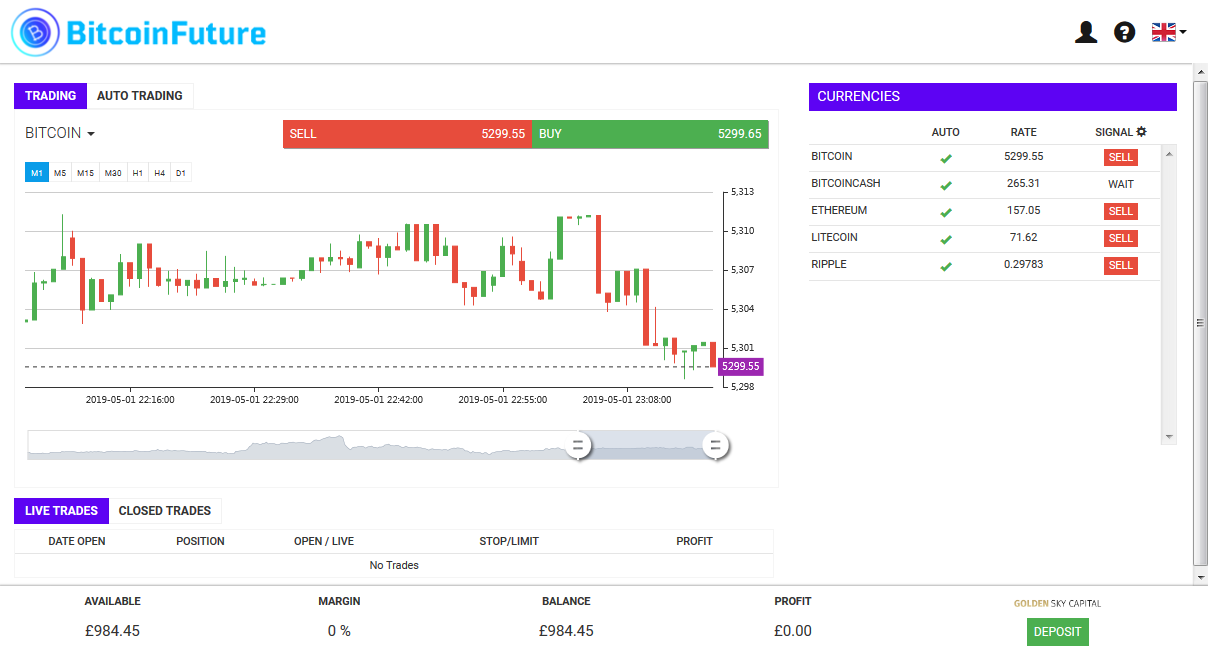

What is Bitcoin Future?

Don’t store coins on Bitcoin exchanges! Chapter 4 Frequently Asked Questions. This is due to Know Your Customer KYC laws which require exchanges to record the real world identity of their clients. Buy Bitcoin Worldwide does not offer legal advice. As with any market, nothing is for sure. Once you purchase the bitcoins you can convert the bitcoins into other cryptocoins. Now with bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit.

Comments

Post a Comment